So, you're ready to take your backtesting game to the next level. You already know what backtesting is and how it can benefit your trading. But you're left with one question: "What should I use to backtest?" With so many options out there, it can be tough to know where to start.

Today, we're going to pit two popular backtesting softwares against each other: FX Replay and TradeZella. We'll break down their key features, price, functionalities, and overall value, so you can decide which one is the best fit for your needs.

We're not here to tell you which platform is the best. That’s ultimately your call. Our aim is to provide an unbiased comparison so you can make an informed decision based on your own trading style and trading goals.

TradeZella vs. FX Replay: Summary of Key Features & Pricing

First let’s zoom out and look at what each of the platforms offer.

FX Replay, launched in 2022, is primarily a backtesting platform. While it has recently integrated a journaling component for backtested trades, its focus remains on providing a tool for testing trading strategies.

TradeZella, on the other hand, offers backtesting as one of its core features but goes beyond that to provide a more comprehensive trading solution, as seen on the sidebar menu, where you have 4 main tabs: Tracking, Backtesting, Mentor Mode, and Education. Essentially, it allows you to automatically track and journal your trades, both backtested and live, collaborate with your mentor, access educational resources, and more.

We know pricing is a huge factor for traders, especially if you’re already paying for multiple subscriptions.

FX Replay’s Pro Plan, at $35 per month, remains a suitable option for those primarily focused on rigorous strategy backtesting with detailed seconds data. However, if you're seeking an all-in-one solution that extends beyond backtesting, TradeZella offers compelling value.

With backtesting available on TradeZella at $29 per month, albeit without seconds data, traders still gain access to every other backtesting functionality alongside advanced analytics and live trade tracking — at the best value among other options.

For those needing the precision of seconds data alongside comprehensive features, the TradeZella Pro Plan is available. Despite a higher price point compared to FX Replay, TradeZella's broader functionality, encompassing both backtesting and live trade analysis, provides a more complete toolset for your entire trading journey.

So if you're looking at value for your money, TradeZella might be the better option.

TradeZella vs. FX Replay: Backtesting Capabilities

We know you’re interested in the backtesting side of each platform, so let’s dive in!

Assets

Both platforms offer backtesting for a variety of assets, including Forex, Futures, Crypto, and Indices. However, TradeZella provides an additional advantage by allowing you to backtest stocks, whereas FX Replay does not.

So if you’re a stock trader looking to backtest your trades, TradeZella is the only choice.

TradingView Charts

Both platforms integrate with TradingView charts, providing you with a powerful and customizable tool for visualizing market data.

Tool Templates

Both platforms offer tool templates to streamline your backtesting workflow and save time.

Multichart and Multipair

Both platforms support multichart and multipair analysis, allowing you to simultaneously monitor multiple charts and instruments.

Currently, both FX Replay and TradeZella allow you to backtest on up to 8 charts simultaneously, and add up to 5 symbols in one session. This provides sufficient multichart capabilities for most traders to effectively monitor and analyze various markets and instruments.

Replay and Jump to Candle

Both platforms allow you to replay market action and jump to specific candles, providing great control over your backtesting sessions.

For FX Replay, right-click on the chart and select "Replay to this date."

For TradeZella, click "Jump to Specific Candle" and then the desired candle on the chart.

Both methods offer efficient ways to navigate your backtesting data. However, TradeZella's visual candle selection provides a more intuitive and direct approach.. While FX Replay's right-click method is also quick, it requires an extra step and may not be as immediately apparent to new users.

Go-to Feature

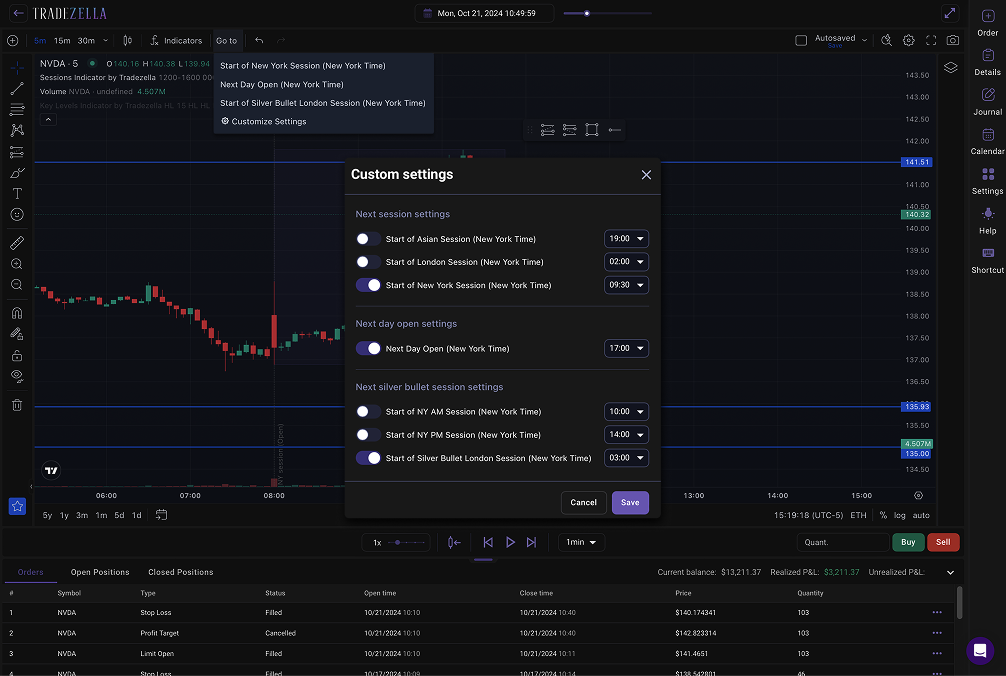

Both platforms streamline your workflow by letting you jump to a specific time or session, without having to manually skip forward. You can customize the start of each trading session as you'd like and skip to the desired period with a click of a button.

Custom Indicators

Both platforms offer custom-made indicators for their users. Because FX Replay has been in the market for longer, they provide more custom indicators as of writing, but TradeZella has started launching their very own custom indicators and will continue to add more.

Automatic Position Sizing

Both TradeZella and FX Replay offer automatic position sizing features, which can be a valuable tool for managing risk and optimizing your trading strategies. This feature allows you to automatically calculate the appropriate position size based on your risk tolerance and trading parameters.

Drag SL & TP

Something that's unique to TradeZella is the ability to dynamically adjust your Take Profit (TP) and Stop Loss (SL) levels during backtesting.

Simply drag and drop your TP/SL orders on the chart to adjust them in real-time as the trade unfolds.

This allows you to react to changing market conditions and fine-tune your risk management strategy on the fly, simulating the active decision-making process of live trading.

As you adjust your TP/SL, TradeZella displays your estimated profit or loss, providing immediate feedback on the potential impact of your adjustments. You can also quickly exit a trade by clicking the "X" button beside your order.

This dynamic TP/SL adjustment feature offers a more interactive and realistic backtesting experience, allowing you to test your ability to adapt to market volatility and optimize your exit strategies. FX Replay does not currently offer this dynamic TP/SL adjustment feature.

Quick Buy and Sell Buttons

Both platforms also provide convenient quick buy and sell buttons, making it easy to place orders during your backtests. This can save you time and streamline your workflow.

Speed Controls

You can adjust the speed of your backtesting session on both platforms. With FX Replay, you can go up to 16x the speed. With TradeZella, you can speed up to 10x. If you prefer to accelerate your backtests significantly, FX Replay might be a better option in terms of speed control.

Seconds Data/Tick

Tick data, capturing price changes at their most granular level, is crucial for precise backtesting and accurate market representation. Both TradeZella Premium and FX Replay offer seconds data, enabling traders to analyze strategies with high precision.

In this regard, you can confidently choose either platform to meet your needs.

Take Partials

Both FX Replay and TradeZella offer valuable features for incorporating partial profit taking into your backtesting strategy. Both platforms let you adjust your position and take partial profits on an existing order. Choose to close a portion of your position by percentage or a specific amount, calculated from either your remaining position or the original order size.

However, FX Replay provides an additional layer of control with its Multiple Take Profit (TP) Levels feature. When setting up an order, you can define multiple TP levels in advance using preset prices, ticks, or percentages.

Ultimately, both platforms offer the necessary tools to effectively implement partial profit-taking strategies during backtesting. The choice may depend on whether you prefer to predefine your TP levels or adjust them dynamically as the trade progresses.

RTH/ETH

When backtesting, the ability to analyze performance during specific trading sessions is essential. TradeZella offers the flexibility to view and switch between both Regular Trading Hours (RTH) and Electronic Trading Hours (ETH).

In contrast, FX Replay currently only provides data for Electronic Trading Hours (ETH), potentially limiting the scope of backtesting analysis.

RTH charts are ideal for analyzing intraday price action and identifying key levels, so for traders who need the flexibility to analyze and optimize strategies across both RTH and ETH, TradeZella provides a significant advantage.

TradeZella vs. FX Replay: Journaling

As mentioned previously, both backtesting platforms offer journaling along with backtesting, but the two differ in depth and flexibility.

TradeZella provides a seamless and powerful journaling experience directly within the backtesting interface. A dedicated column beside the chart allows for real-time note-taking and tagging without disrupting your backtesting workflow. No need to switch between pages.

Key features include:

- Session and Trade Notes: Maintain both broad session reflections, as well as trade-specific analysis.

- Playbook Integration: Attach playbooks to track strategy rules and ensure that you’re following your rules during backtesting.

- Customizable Tagging & Reporting: Use highly customizable tags (e.g., entry model, timeframe, mistakes) to categorize trades. Each tag generates corresponding performance reports for in-depth strategy refinement. One thing to note is that you can tag your trades while you’re in the backtesting session.

- Rich Media: Easily add images and screenshots for visual context.

- Automatic Note Population: When reviewing an individual trade later, all associated notes, tags, and attachments are automatically populated, providing a complete and readily accessible record of your analysis and decision-making process.

In essence, TradeZella's journaling is designed to be a dynamic and comprehensive tool that supports continuous learning and improvement by providing a complete and easily accessible record of your trading journey.

FX Replay

- Separate Window Journaling: FX Replay's journaling feature opens in a new window, requiring traders to switch contexts and potentially disrupting their workflow.

- Individual Trade Focus: Journaling is primarily focused on individual trades, with currently no way of writing a journal entry for the whole session.

- Basic Tagging: While tagging is available, it's limited to a single category, reducing flexibility.

- Standard Features: Users can add screenshots, utilize checklists, rate confidence levels, and add general notes.

- Less streamlined: The need to open a new window, and the limited tagging, makes the user experience less streamlined than TradeZella.

In summary: TradeZella offers a more integrated, comprehensive, and user-friendly journaling experience, with advanced tagging and reporting features. FX Replay provides basic journaling functionality but with a less seamless workflow. In this aspect, TradeZella clearly shines better.

TradeZella vs. FX Replay: Analytics

Both TradeZella and FX Replay offer comprehensive analytics dashboards to help you evaluate your backtesting performance. However, they take slightly different approaches:

FX Replay offers a custom analytics dashboard designed specifically for backtesting sessions. This dashboard provides you with detailed insights into your backtest performance. Their dashboard includes:

Basic backtesting stats

- Time invested backtesting

- Historical time replayed

- Time invested by day (min)

- Number of trades taken

- Overall win rate

- Number of trades by symbol

Advanced analytics

- Profit & loss chart

- Winners vs Losers

- Buy vs Sell

- Performance by Session

- Performance by time

- Performance by day

- Performance by month

- Performance calendar

- Monte Carlo simulation

TradeZella also provides basic backtesting stats like:

- Total data backtested within a certain time

- Total time spent backtesting

- Sessions win rate: Winning sessions over the total number of finished sessions

- Trade win rate

- Total time invested backtesting

Additionally, TradeZella takes a unique approach by presenting your performance analytics as if they were actual trades taken on live markets by giving you the exact same analytics as they provide on your live accounts. This allows you to visualize your results in a more realistic and intuitive way.

Clicking on the Dashboard icon on the sidebar takes your backtesting dashboard. You can either select which specific session you’d like to review or choose to review multiple sessions at once.

Now let’s dive deeper into the data that’s available for you.

Dashboard

Clear overall glance at your backtesting session performance in different views (Dollar, Percentage, R-Multiple, Ticks, Pips, Points)

- Account Balance & P&L

- Daily Net Cumulative P&L & Net Daily P&L

- Trade Win Rate & Day Win Rate

- Avg Win/Loss Trade

- Trade Expectancy

- Streaks: Current Day Streak, Current Trade Streak, Current Streak

- Max Drawdown & Average Drawdown

- Advanced Calendar

- Zella Score - Scores your overall performance

Trade Log & Tracking

Gives you a detailed and customizable list of all the trades you’ve taken in that session. Clicking on an individual trade allows you to review that trade even deeper, as if it were an actual trade taken on the live market.

Your chart with your entries and exits, your stats, your tags, and your notes are automatically populated in this page.

Reports

This is where your data comes together and where you can review your strategy’s strengths and weaknesses on a much deeper level. Access 50+ reports to discover key insights in your strategies, like:

- Peak trading times

- Optimal holding periods

- Average risk and reward

- Best or worst trading days

- Most profitable months

- Performance by price, volume, instrument

Compare Symbols, Tags, Sides, etc.

TradeZella's robust analytical tools empower traders to go beyond basic performance metrics.

As shown in the image, you can create distinct groups to compare various aspects of your trading. This allows you to directly compare performance across different symbols, trade directions (long or short), and timeframes. By leveraging customizable tags, you can even analyze the effectiveness of different trading approaches.

TradeZella provides a comprehensive statistical breakdown for each group, including key metrics like win rate, average win/loss, and total P&L. This data-driven approach, combined with clear visualizations, enables traders to identify strengths and weaknesses, ultimately leading to more informed trading decisions and strategy refinement.

Although FX Replay also has comparison reports, TradeZella offers a more flexible functionality, allowing you to dive deeper into your data.

In terms of reporting, it’s clear that both TradeZella and FX Replay offer comprehensive analytics dashboards to help you analyze your backtesting performance.

However, TradeZella's unique approach of presenting analytics as if they were live trades and its additional features, such as the intensive trade log and in-depth reporting, make it a strong contender for traders seeking a more intuitive and in-depth analysis of their backtesting results.

Mentor Mode

TradeZella introduces a unique feature unmatched by other backtesting platforms: Mentor Mode. This innovative tool fosters deeper collaboration between mentors and traders specifically within the context of backtesting, taking personalized guidance to the next level.

How it works:

- For Traders: Invite your mentor to directly access your backtesting sessions, including your historical trades, analytical breakdowns, and detailed journals. This provides your mentor with a comprehensive view of your backtesting methodology, enabling them to offer targeted feedback and accelerate your learning.

- For Mentors: Mentor Mode becomes a valuable asset for those offering backtesting guidance. Easily review your students' backtesting performance, identify areas for improvement in their strategies, and provide specific advice based on their individual backtesting results. This fosters a more efficient and effective learning environment for mastering backtesting techniques.

TradeZella's Mentor Mode bridges the gap between backtesting theory and practical application, creating a powerful synergy between mentors and traders seeking to master historical data analysis.

TradeZella vs. FX Replay: Summary

Both TradeZella and FX Replay offer robust solutions for your backtesting needs, each with its own strengths and weaknesses.

FX Replay excels in providing a focused and streamlined backtesting. With its intuitive interface and powerful features like multi-chart analysis, custom indicators, and high-speed replay, FX Replay allows you to efficiently test and refine your trading strategies. This platform is for traders who only want an in-depth backtesting platform.

TradeZella offers a more comprehensive and integrated approach to trading analysis, encompassing backtesting, live trade tracking, advanced analytics, and mentorship. It provides a compelling entry point for traders seeking a feature-rich platform at a much lower cost. TradeZella's strengths lie in its versatility, offering tools to support traders throughout their entire trading journey.

So, which platform is right for you? The best choice depends on your specific needs and preferences. Consider factors such as your budget, the level of customization and functionalities you require, and whether you want a platform that can support you throughout your trading journey, from backtesting to live trading.

If TradeZella sounds like the ideal fit for you, you can start your journey by visiting their website here.

Remember, the key to successful trading is continuous learning and improvement. Whichever platform you choose, make sure to leverage its features to gain a deeper understanding of the markets and refine your trading strategies.